2024 Schedule 1 Irs Instructions – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com . Internal Revenue Service. “Schedule C: Profit or Loss from Business,” Page 1. Internal Revenue Service. “2022 Instructions for Schedule C: Profit or Loss from Business,” Page 9. Internal Revenue .

2024 Schedule 1 Irs Instructions

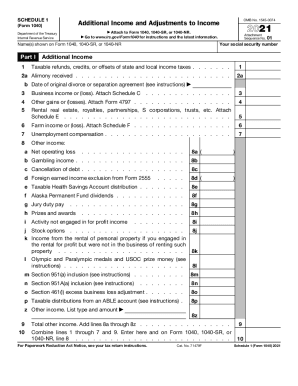

Source : www.irs.govIRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.comIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

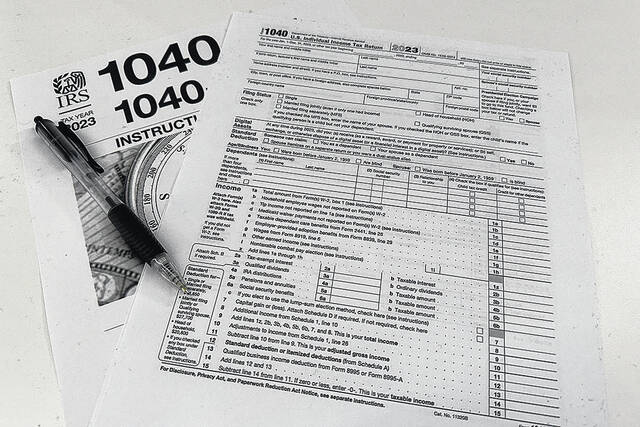

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.com2024 Tax Update and What to Expect

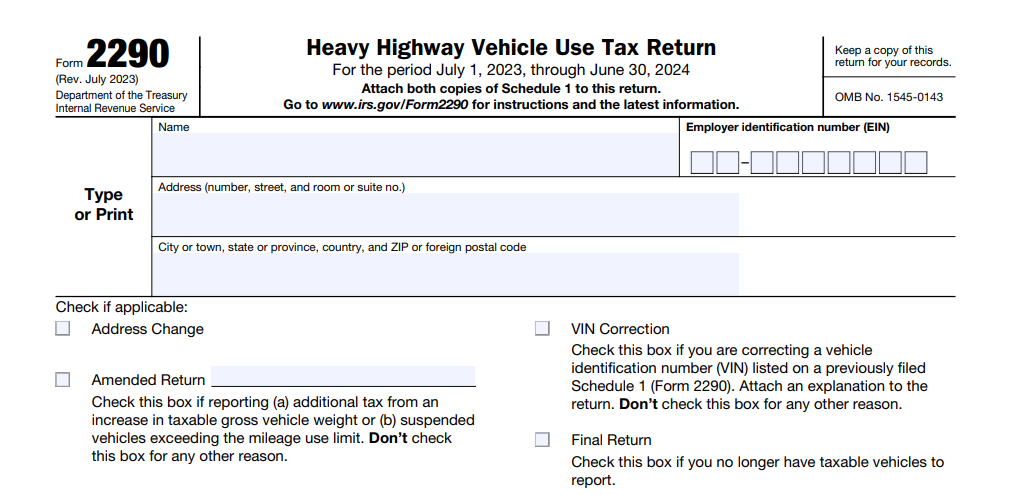

Source : sourceadvisors.comInstructions for IRS Form 2290 | How To File Form 2290 for 2023 2024

Source : www.ez2290.comAP | Tax season is under way so how do we navigate? | Laurinburg

Source : www.laurinburgexchange.comTax season begins: What to know for filing this year | VPM

Source : www.vpm.orgIRS Releases Updated Schedule 1 Tax Form and Instructions for 2023

Source : www.wbtw.com2024 Schedule 1 Irs Instructions 1040 (2023) | Internal Revenue Service: Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. . One possibility is to include a zero with a “see note” on line 7a, the “other income” line of a 1040 form, which is reported on line 8 of Schedule 1. There’s no perfect solution, but one thing is .

]]>